In addition, the global vanilla market is influenced by inconsistent production, quality differences, and competition from synthetic vanilla, all of which affect pricing. Uganda, as a producer of naturally grown vanilla, is also impacted by these global trends. Buyers often shift their purchasing decisions based on the availability of natural vanilla from countries like Madagascar and Indonesia. Understanding these market forces, which influence buyers to switch suppliers, is essential for actors in Uganda’s vanilla industry. It helps Ugandan actors make better decisions about pricing, marketing, and production strategies.

Source: Bank of Uganda, 2024

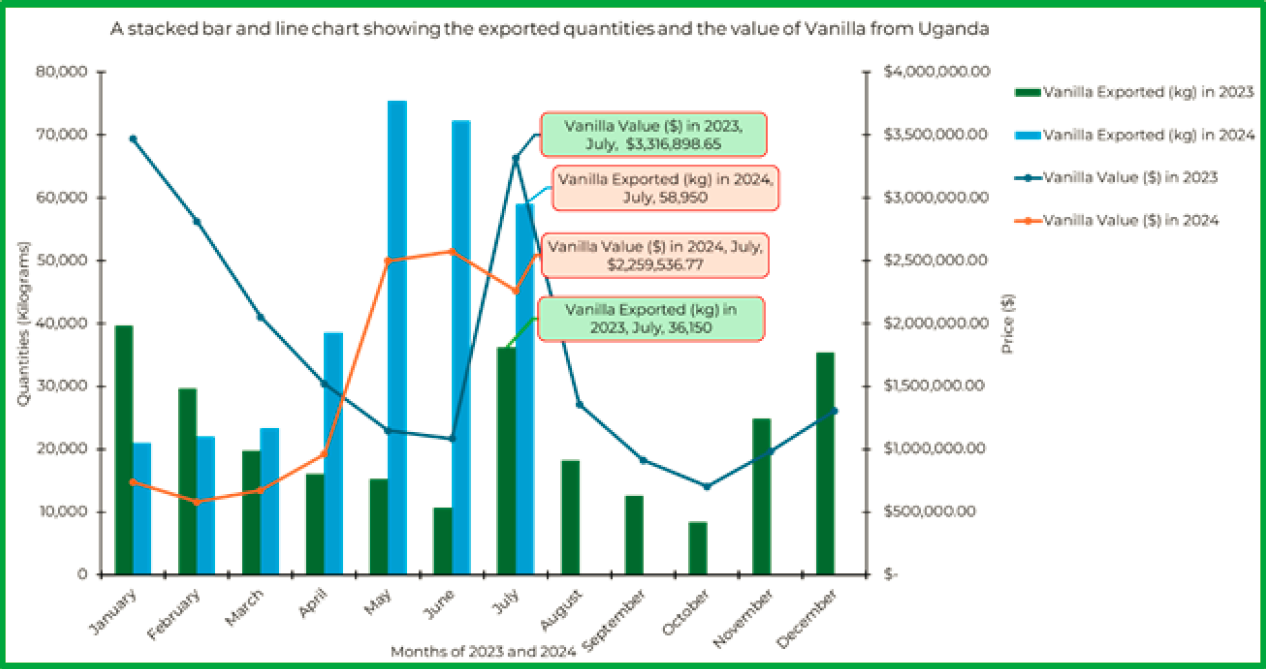

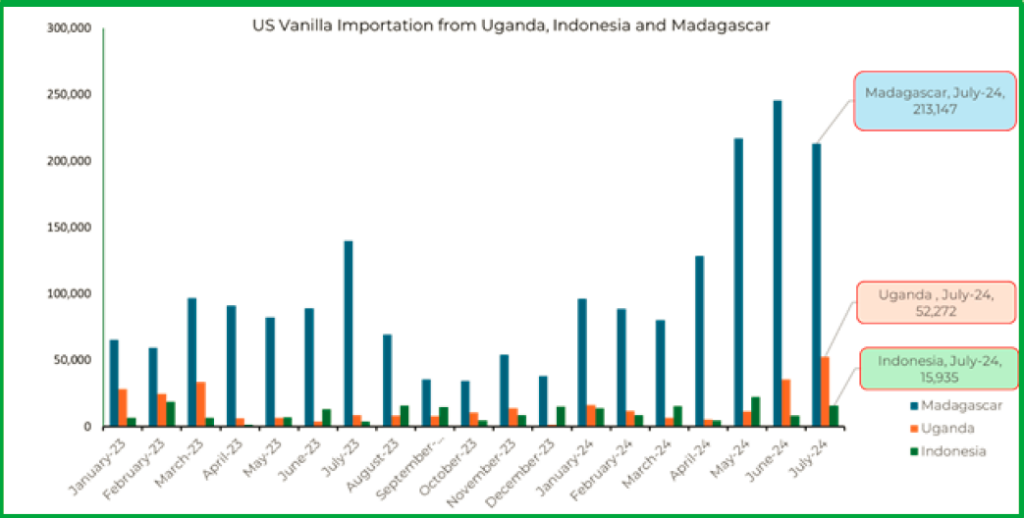

The U.S. remains a major buyer of vanilla from Uganda, Madagascar, and Indonesia. In 2023, Uganda exported 153,125 kilograms of vanilla worth $16,541,082.55, at an average price of $108.02 per kilogram. This represented 57% (151,990.5) of Uganda’s total exports that year, which amounted to 266,650 kilograms. Meanwhile, Madagascar exported much larger quantities, totaling 853,857 kilograms, valued at $146,551,033.74, with an average price of $171.63 per kilogram, making up 28% of their total exports in 2023.

We note that Uganda performed better in the U.S. market than Indonesia, despite Indonesia producing nearly ten times more vanilla. Indonesia exported 115,701 kilograms to the U.S., worth $11,015,943.24, at an average price of $95.21 per kilogram, accounting for 6% of their total production. This difference could be due to varying market strategies and the quality of vanilla from Indonesia.

As of July 2024, Uganda has exported 138,836 kilograms, valued at $6,295,488.25, with an average price of $45.34 per kilogram. Madagascar has exported 1,069,424 kilograms, valued at $52,325,276.06, with an average price of $48.93 per kilogram. In the same period, Indonesia has exported only 88,143 kilograms, worth $5,184,334.99, at an average price of $58.82 per kilogram, slightly higher than the prices of Ugandan and Madagascan vanilla.

Source: US Customs, 2024

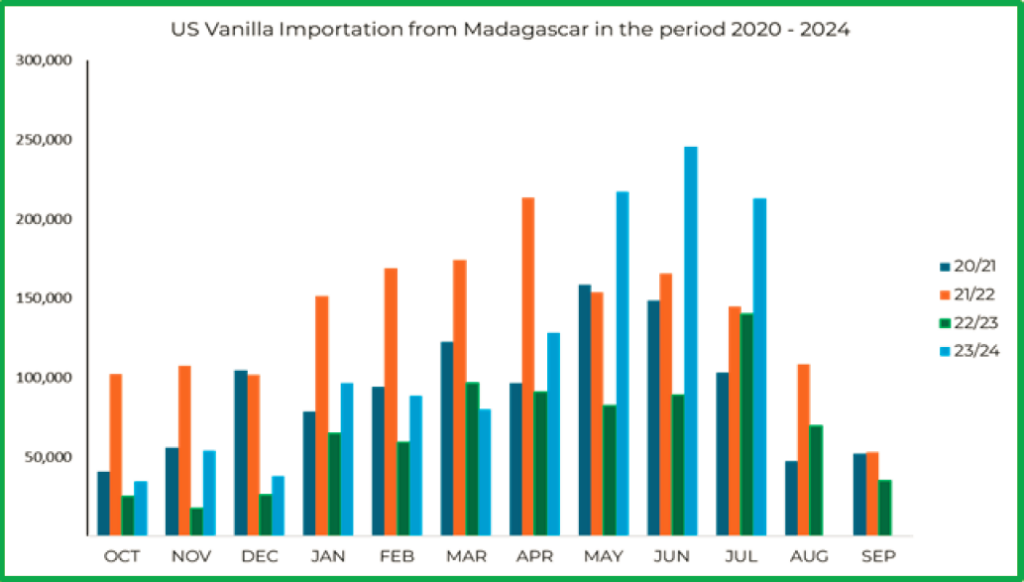

A detailed analysis of Madagascar’s vanilla exports from 2021 to 2024, shows that the largest volumes of vanilla are typically exported between May and July. This suggests potential opportunities for Ugandan vanilla to compete with Madagascan vanilla during periods of lower exports, such as between October and March.

Source: US Customs, 2024

Since the early 2000s, 17 countries around the world have been involved in vanilla production. However, according to the latest FAOSTAT data, only 13 countries continue to produce vanilla today. These countries can be grouped into four categories based on their current production levels:

According to FAOSTAT (2024), there have been some changes in the rankings of certain countries. For example, Indonesia, which was the top producer ahead of Madagascar in the early 2010s, is now in second place. China, which held third position in the early 2010s, has dropped to fifth, along with Papua New Guinea. Uganda, once among the top six vanilla producers globally in 2007, has now fallen to ninth place.

Despite this, most countries have maintained their production rankings. Uganda, however, stands out with the potential to rise within the lower middle-producing group. With two harvest seasons each year, Uganda could surpass Mexico and potentially move into the upper middle-producing category.

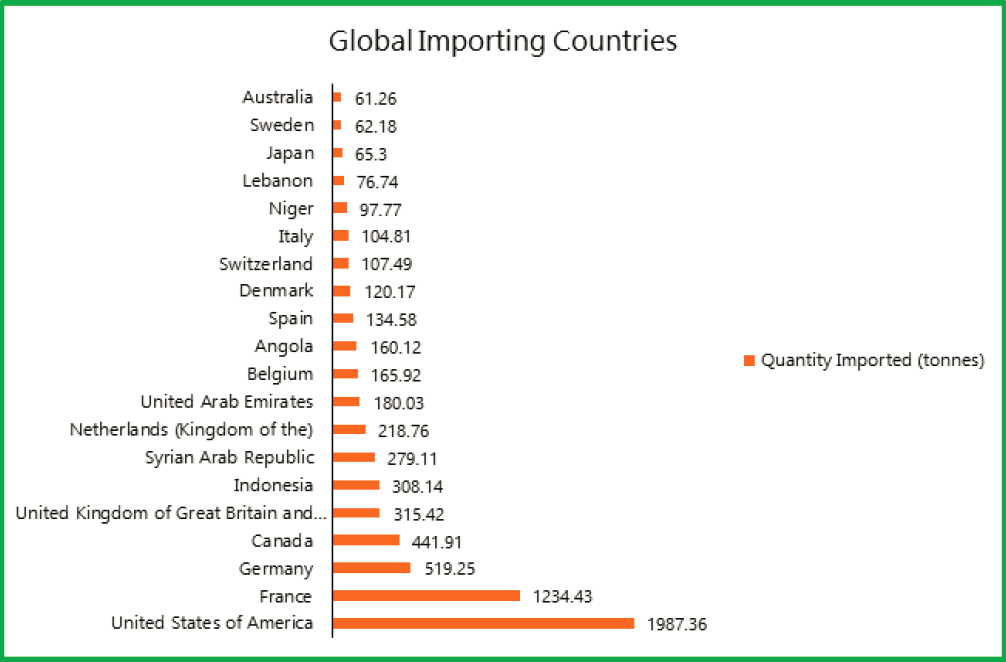

Ugandan vanilla is mainly exported to the United States, followed by Germany and France, with a few others from the European Union, including Ireland.

| Countries, Current Buyers and Quantities | Countries, Potential Buyers |

| United States (Chicago, Illinois) | ADM: 150-200 MT, with 30% from UG | United States (HuntValley, Maryland) | McCormick: 180-250 MT |

| Switzerland (Vernier, near Geneva) | Givaudan: 180 MT, with 10% from UG | France (Le Bar-sur-Loup) | Mane: 100-250 MT |

| Switzerland (Geneva) | Firmenich: buys 150 MT | Ireland (Tralee, County Kerry) | Kerry: 60 MT |

| Germany (Holzminden) | Symrise: 200 MT, with 5% from UG | Japan (Tokyo) | Takasago: 80 MT, currently on trials with UG. |

| Germany (Bielefeld) | Dr. Oetker: 80-100 MT, with 15% from UG | United States (New York City) | IFF: 150 MT |

| France (Paris) | Prova: 80-100 MT, with 15% from UG | ||

| France (Le Cateau- Cambrésis) | EuroVanille: 80-100 MT, with 10% from UG | ||

| United States (Waukegan, Illinois) | Nielsen Massey: 80 MT | ||

| United States (Brooklyn, New York) | Virginia Dare: 50 MT, with 10% from UG |

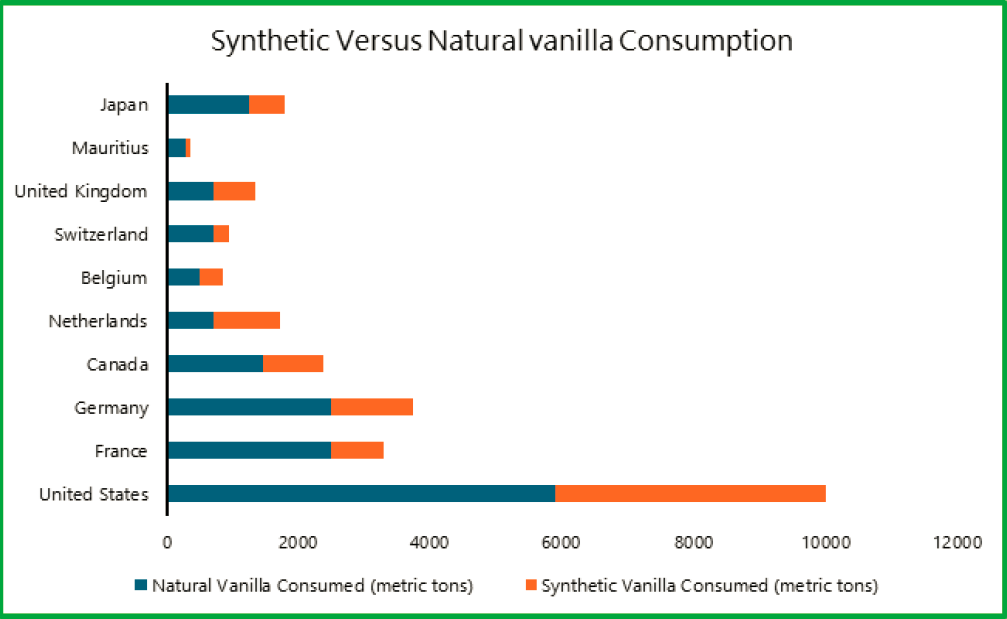

| There is significant potential for Ugandan natural vanilla in the international market, especially in the United States, where synthetic vanilla currently dominates. While synthetic vanilla may appear cheaper, consumer preferences, particularly in places like France, are shifting towards naturally produced vanilla due to growing awareness of the differences between synthetic and organic vanilla. | Consumers and some food processors are increasingly recognizing that natural vanilla offers a richer, more complex flavor, with floral, fruity, and spicy notes, whereas artificial vanilla tends to have a simpler taste. This shift is supported by data from FAOSTAT and SLOFOODGROUP, which also discuss the ethical considerations of choosing natural vanilla over synthetic alternatives. |

In order to address the challenges that cause vanilla buyers to switch exporters due to inconsistent quality and production levels, a more robust strategy is needed to keep stakeholders engaged especially the growers. It is against this background therefore, that VANEX will continue to advocate for the promotion of a stable supply of high-quality, natural vanilla, that is produced in a socially, environmentally and economically sustainable way. Sustainable production will help to guarantee the survival of the sector, as it appeals to global consumer demands, and will maintain the productivity of local vanilla producing farms. VANEX foresees that in the short to medium turn, a traceable, fair and transparent supply chain will be demanded by global buyers, following the trend of other commodities, such as coffee and cocoa.

Providing end-to-end data traceability for your supply chain

Cphatow is a Ugandan- based IT Company providing Digital

Internal Control Systems (DICS) in data collection and

processing across various value chains including Vanilla.

We offer Cpha-Agro solution, a hybrid application used in

data collection and processing, consisting of 2 main

components a Mobile Application; an android-based

application used particularly in the field to collect data while

offline (no internet need during data collection) and a Web

Application; used to view, edit, and manage field data sent

by your field officers.

Please contact us on:

P.O. Box 102802, Sal house, Nkrumah Rd, Kampala Uganda

+256 777 830 266, +256 781 166 834

info@cphatow.ug or cphatow@gmail.com

www.cphatow.com @cphatow